by Geoff | Mar 7, 2018 | Getting a Mortgage, Mortgage Broker, Rates

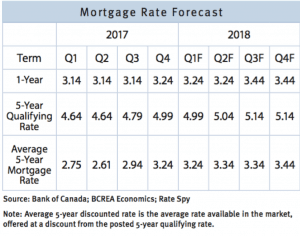

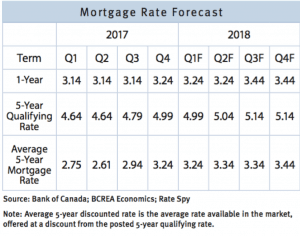

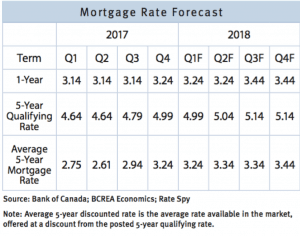

2017 was a year of change for the Canadian Mortgage Market. With the announcement of the B-20 guideline changes requiring all insured or uninsured mortgages to undergo stress testing. In addition, the removal of mortgage bundling and the continued rate rises from the...

by Geoff | Jan 18, 2018 | Getting a Mortgage, Market Updates, mortgage trends, Rates

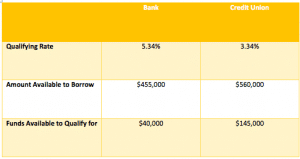

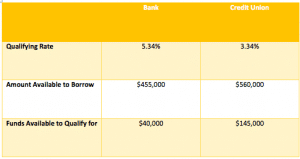

Banks and Credit unions are often grouped together into one category under “financial institutions”. While they may have several similarities in terms of financial service offerings, in the world of mortgages the banks and credit unions have little in...

by Geoff | Jan 9, 2018 | Mortgage Broker, Rates, Refinancing

Ask any mortgage broker and they can tell you that there are a handful of misconceptions that the public has about working with a mortgage broker. From questioning their credentials (we all are regulated and licensed within our own province, and are constantly...

by Geoff | Oct 13, 2017 | Getting a Mortgage, Mortgage Broker, Rates

A mortgage in its simplest form is a contract. It has terms, conditions, rights and obligations for you and the lender. When you sign on the dotted line, you are agreeing to those terms for the length of time laid out in the contract. However, sometimes life throws us...

by Geoff | Jun 26, 2017 | Bank of Canada, Economy, Finances, Rates

There has been buzz lately about the rising of interest rates and what that could mean for Canadians. The media can tend to pump up these mortgage rate increases as though it were the appending apocalypse, touting headlines saying Canadians are headed in to mass debt,...

by Geoff | Jun 16, 2017 | Rates

Fixed or Variable rates? Which one is right for me? There are many factors to consider and it isn’t a simple question to answer. Our clients need to understand how they work-and we are going to show you! First, let’s start with the basics. Fixed vs....

Recent Comments