Blog

Our Latest Posts

The latest thoughts and insights from Geoff Lee and GLM Mortgage Group | Dominion Lending Centres

Changes in the Mortgage Industry | From stress testing and the BC Budget, to Rate Increases and More

The mortgage industry seems to be ever-changing. What was applicable one day seems to no longer apply to the next and at times, it can be confusing to navigate through what all of these changes mean--and how they impact you directly. As Mortgage Brokers, we firmly do...

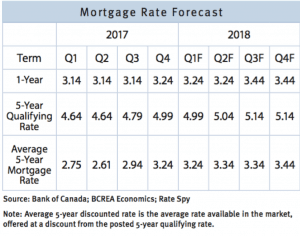

Where are Canadian Mortgage Rates Going in 2018?

2017 was a year of change for the Canadian Mortgage Market. With the announcement of the B-20 guideline changes requiring all insured or uninsured mortgages to undergo stress testing. In addition, the removal of mortgage bundling and the continued rate rises from the...

What is the Canada Mortgage and Housing Corporation (CMHC)?

The Canada Mortgage and Housing Corporation (CMHC) is a corporation that most are semi-familiar with, but do not know what CMHC actually does. CMHC is Canada's authority on housing. They contribute to the stability of the housing market and the financial system. They...

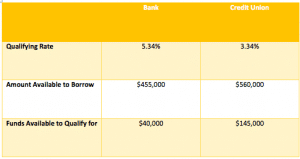

Bank vs. Credit Union-A who is who in borrowing

Banks and Credit unions are often grouped together into one category under "financial institutions". While they may have several similarities in terms of financial service offerings, in the world of mortgages the banks and credit unions have little in common. As...

Bank Broker vs. Mortgage Brokers | Here’s the Scoop

Ask any mortgage broker and they can tell you that there are a handful of misconceptions that the public has about working with a mortgage broker. From questioning their credentials (we all are regulated and licensed within our own province, and are constantly...

What is an Annual Mortgage Review?

There is a lot that can change in the real estate market and the economy from year to year. As a homeowner with a mortgage, it is important to make sure that you are getting the most savings possible. A mortgage review can help you out with this. What does a mortgage...

How to Repair Credit

Credit history has become one of the most important factors banks consider when deciding whether or not they want to lend you money. Your credit history can determine your ability to buy a car, rent an apartment, or even to purchase your first home. Everything you do,...

UPDATED: OSFI MORTGAGE CHANGES

As many of you may remember, this past October the Office of the Superintendent of Financial Institutions (OSFI) issued a revision to Guideline B-20 . The changes will go into effect on January 1, 2018 but lenders are expecting to roll this rules out to their...

Mortgages and Paperwork

Paperwork-it’s a fact of life. You need it and we as mortgage professionals also need it. Below is a list of must have documentation BEFORE you start going through the mortgage approval process. Personal Information This will be the basic information we require...

Mortgage Insurance 101

When you purchase a property, you may be a little overwhelmed by all the insurance offers related to the purchase of said property. Mortgage Insurance, Condo Insurance, Mortgage Default Insurance, Earthquake Insurance; the list goes on and on. It can be confusing, and...

GLM CONTEST | Enter to Win!

Leave a Review, that's all you have to do! Christmas has come early here at GLM! If you have worked with us in the past, learned something from GLM, or are a GLM fan we want to give you the chance to win DINNER AND A MOVIE ON US! To enter we made it as...

By The Numbers | Mortgage Numbers you need to know!

Numbers. They are an integral part of our day to day life. Your everyday numbers are those that you have memorized and repeated time and time again...like your phone number, age, birth date, etc. Just like you have those numbers memorized, it is just as important to...

New Mortgage Changes | What You Need to Know

On October 17, 2017, OSFI (Office of the Superintendent of Financial Institutions) announced that effective January 1, 2018 the new Residential Mortgage Underwriting Practices and Procedures (Guidelines B-20) will be applied to all Federally Regulated Lenders. Note...

What is an interest rate differential (IRD)? How do you calculate it?

A mortgage in its simplest form is a contract. It has terms, conditions, rights and obligations for you and the lender. When you sign on the dotted line, you are agreeing to those terms for the length of time laid out in the contract. However, sometimes life throws us...

A Guide to Rent to Own Properties

Renters, this article is for you! With the market still holding strong, with high prices and low inventory, the thought of getting out of your rental may seem daunting. However, if you have an accommodating landlord and the will to save, Rent to Own (RTO) may just be...

CMHC: Go Green & Save!

We all do different things to go green in our day to day life: using reusable shopping bags, biking instead of driving, re-using water bottles…you name it. All of the various steps we take to minimize our environmental foot-print gives us the...

VIDEO: Rent To Own’s-Should You Do It?

We were excited to have a few moments to interview Rent to Own expert, Tim Grier of Lindsay Kenney LLP to get a few details on Rent to Own's and what you need to know before you enter into one. Watch the video above and read the full transcript below! Geoff:...

Should I Invest in Real Estate?

If we told you that right now is a good time to invest in real estate, would you think we are crazy? How could that be possible right? The rates are rising, home prices are still astronomically high, and home inventory is at an all-time low. However, today we are...