Blog

Our Latest Posts

The latest thoughts and insights from Geoff Lee and GLM Mortgage Group | Dominion Lending Centres

Is Being Mortgage Free My Plan for Retirement?

Most people believe that being mortgage free is their plan for retirement. That means paying off your mortgage as fast as possible becomes the priority and having other forms of investments are considered only after your property is paid off. It is important to decide...

Top Five Home Renovations that Increase Property Value

Looking to increase your homes property value? Here are five of the best renovations you can do to your home to increase property value. These five renovations can sometimes have a return on investment 5-6x what they cost. # 5 Flooring Flooring is one of the most...

CMHC Sees Problematic Housing Conditions in Canada

The Canadian Mortgage and Housing Corporation (CMHC) issued its quarterly housing market assessment and outlook yesterday, suggesting that, for the first time ever, there are “problematic conditions” in housing markets at the national level in Canada (see table below...

Bi-Weekly Payment Workaround

Most of us know that changing your mortgage payment from monthly, or semi monthly, to an accelerated bi-weekly payment instantly reduces your standard 25 year amortization by 2.58 years with today’s rates. (If you didn’t know that, you’re likely not working with the...

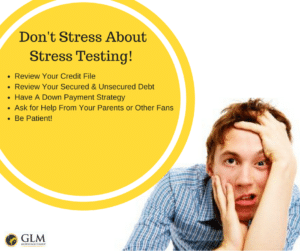

Are You Stressed About The New Stress Testing? Don’t Be!

That’s right! Sure the new mortgage rules from our Federal Government on October 17th can be a bit confusing, here are five tips to help you with your mortgage while at the same time, reducing your stress. 1. Review your Credit File: Good credit is your ticket to...

Practice Your Mortgage-Before you Buy!

Practice your mortgage… What exactly do I mean by that? Well, if you’re a first-time buyer and just beginning to explore the housing market, chances are you’re currently renting or living with family, and very likely paying less than you will be going into your new...

3 Steps to Keep Your Credit In Check

If you have have overextended yourself with credit card debt, or have consolidated all of your consumer debt into your mortgage, or are at the point where you just want to cancel your credit cards, we have the 3 steps for you to follow to get your credit back in...

A History of Mortgages

With the up and coming changes to Mortgages on October 17th, we took a moment to look back at the evolution of the mortgage, and to highlight these new changes and what they mean LOOKING BACK BEFORE 2008 During this time, lending and mortgages were much...

A Look at the Economy: Job Reports for Canada & The US

A perfect example of the unpredictable volatility in the Canadian jobs report, the September gain of 67,000 jobs was dramatically larger than economists’ expectations of roughly 7,500 new jobs. Most of the rise was in part-time work, however, and it was boosted by...

5 Reasons a Mortgage Broker is Your Best Choice

So it seems that there are still Canadian consumers who have reservations or misunderstandings about why a mortgage broker is their best choice. Time to take a quick look at 5 reasons you should use a broker. 1. Almost always free to use. 41% of...

Mortgage Rates: In the Midst of Chaos-5 steps to Focus

By now you will have likely heard that the Federal Finance Minister has made drastic changes to mortgage lending rules making it tougher to qualify for a mortgage. For Canadians with less than a 20% down payment, their purchasing power has been dramatically reduced....

Thinking of Selling? Costs You Should Know About!

Often times it’s the simple math that will betray you when selling a property. In your head you do quick calculations, you take what you think your property will sell for and then subtract what you owe on your mortgage, and the rest is your profit! Well… not so fast,...

Not all Doom & Gloom-New Canadian Mortgage Rules

The Minister of Finance announced on Monday new Canadian mortgage rules effective October 17,2016. The new rules will impact high ratio buyers – those with less than 20% down payment. Other rule changes are expected to follow so stay tuned for details as they unfold....

6 Steps to Mortgage Approval—After Bankruptcy.

Bankruptcy challenges are daunting. But it doesn’t mean you’ll never get a mortgage again. In fact, if your loan to value is low (a bigger down payment) and your income is stable with good job tenure, you are well on your way to mortgage success Here are the 6 crucial...

KNOW HOW YOUR MORTGAGE IS REGISTERED

Every mortgage secured by a property will be registered with the land title office.There are two ways your mortgage can be registered on title: Standard charge or collateral charge. Not long ago, most lenders registered all mortgages as a standard charge. In recent...

10 Questions for First Time Buyers

10 Questions for First Time Buyers As a first time home buyer, the process of purchasing a home can seem very daunting. From a financing standpoint, here are 10 common questions I hear from first time home buyers. 1. What’s your best rate? This is by far the most...

5 Reasons Why Your Bank Rate Isn’t Better

5 Reasons Why Your Bank Rate Isn't Better I recently had a client ask me what difference I could provide given that his bank’s website was offering the same interest rate I had quoted him the day before. Before responding to him, I went on his bank’s website to check...

How to Grow Strong Credit

How to Grow Strong Credit One of the comments I hear the most often from people is that they wish financial literacy was taught in school. I cannot agree more. The worst of it is when I meet with someone and though they have the employment and the down payment...