Blog

Our Latest Posts

The latest thoughts and insights from Geoff Lee and GLM Mortgage Group | Dominion Lending Centres

Home Improvement Refinancing

With interest rates sitting at the lowest we’ve ever seen – low rates never before seen by your parents and even your grandparents – now is an ideal time to tap into the available equity in your home or cottage to fund your renovation or landscape needs. But these...

Buying Your First Home in Canada

If you’re like many newcomers to Canada, one of your top financial goals is likely to own a home in your new country. With that in mind, you’ve likely considered how much you can afford as a down payment, what you’re looking for in a home and what neighbourhood you’d...

The basics of construction loans

Let's proceed on the assumption that you're taking out an individual construction loan. Such loans, which can be tough to get without a previous banking history because of the lack of collateral (a finished home), have special guidelines and include monitoring to...

Fraser Valley Real Estate Sales See Third Hottest April Ever

Sales volumes up 37 per cent year over year and listings down 14.5 per cent as Valley mirrors hot Vancouver market. Home sales growth in the Fraser Valley matched that of Greater Vancouver in April, rising 37.5 per cent year over year, according to Fraser...

The Changing Shape of Canada’s Economy

"B.C. is poised to lead the provinces in economic growth for the first time in a decade, according to BMO’s Blue Book report." [Source] The latest edition of the BMO Blue Book shows how Canada’s economic landscape is shifting due to the lower oil prices...

Home Equity Line of Credit Popular for Renovations

You've spent hours picking the perfect tile, counter tops and cabinets. You researched the best stoves, dishwashers and refrigerators. Your budget is set and your favourite contractor is available. Now you just need to figure out how to pay for it all. It starts with...

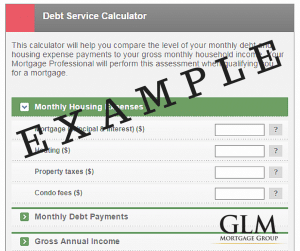

Investment Property Financing

Today's blog will cover some highlights of Investment Property financing with GLM Mortgage Group. It is all about Debt Servicing DEFINITION of 'Debt Service' The cash that is required for a particular time period to cover the repayment of interest and principal...

Three Reasons Bank of Canada Rate Cuts Mean Great Mortgage Deals for You

We're seeing extraordinary times in the mortgage industry – so what does that mean to the consumer who is just looking for a good mortgage deal? You’d have to have lived in a cave these past few months not to know we are going through extraordinary times...

Home buyer and seller activity outpaces historical averages in February

Conditions within the Metro Vancouver* housing market continued to strengthen in February as home sale and listing totals came in well above the region’s ten-year average for the month. The Real Estate Board of Greater Vancouver (REBGV) reports that...

Commercial real estate sales top 6 Billion Dollars in the Lower Mainland in 2014

The Lower Mainland’s commercial real estate market hit a five-year high in terms of the number and value of sales within the year when commercial real estate sales top 6 billion dollars in the Lower Mainland in 2014. There were 1,963 commercial real...

Four Myths About Canadian Household Debt

Canadians are obsessed with debt — snapping up loans with record low interest rates to get in it — and then fretting, as debt ratios rise — about getting out of it. No other financial issue, apart from the ever-looming housing bubble, has generated as much angst in...

Controlling the Economy

Today we are looking at the Bank of Canada and how it affects our economy. Have you been asking questions about the Canadian economy and its interest rates? Questions like…. What is going on with the mortgage industry? Why are interest rates going down? Why are...

CMHC expects moderation in Canada’s housing market this year and next

The Canada Mortgage and Housing Corp. says it expects housing starts in 2015 will dip slightly compared with last year, but remain broadly in line with economic and demographic trends. The federal housing agency says housing starts are expected to decline by 1.0% in...

Did You Know In Some Cases You Can REFINANCE Up To 95%

Did You Know In Some Cases You Can REFINANCE Up To 95% Case Study #9 Joseph and Lianna decided to end their marriage. They decided that Lianna, a Registered Nurse, would get the matrimonial home and Joseph, who owns his own business, would be paid out by the couple...

How to Declutter Your Finances in 2015

2015 is off to a fast start, so, before it gets TOO late, here are some strategies from the experts on how to declutter your finances in 2015: Buy a shredder. “There is no reason to hang on to old utility bill stubs, credit card and bank statements, and the like,”...

The CMP Canadian Mortgage Awards

The CMP Canadian Mortgage Awards recognizes and celebrates excellence across the entire spectrum of mortgage brokering. There are 21 organizational and individual categories that have been designed to ensure national recognition of both large and small organizations...

2015 Mortgage Guide

2015 Mortgage Guide Get Clients Pre-Approved A pre-approved mortgage puts your financing in place before you make an offer on a home. With a pre-approved mortgage, you'll be able to make a firm offer on the home of your choice. A pre-approval can hold a rate...

New to Canada Homebuyer’s Information

What you need to know when buying a home in Canada. Here are some facts you need to know for qualifying to borrow: You must have immigrated or relocated to Canada within the last 36 months for the New to Canada Program. You must have 3 months minimum of full-time...