Blog

Our Latest Posts

The latest thoughts and insights from Geoff Lee and GLM Mortgage Group | Dominion Lending Centres

Money Saving Renovation Tips

Everyone has a different reason for wanting to renovate their home. You may be looking to make a change in the way your home looks or feels, or you may want to fix a maintenance issue or make your home more comfortable or energy efficient. Whatever your reason,...

Q & A on the BC First Time Home Buyers Bonus – Part 2

A few weeks ago we blogged about the great new BC First Time Home Buyers Bonus. That was only a portion of the pertinent information available regarding the bonus. Today I would like to give you the rest of the most important information! As always, at any time...

Q & A on the BC First Time Home Buyers Bonus

You may recall the first post I made regarding the BC First Time Home Buyers Bonus back in February, but there have been a LOT of questions surrounding it in the office lately, so I thought I would do some overall Q & A for you today. This is really an exceptional...

We Do Mortgages … Anywhere!!

"I live in North Van …can you even do mortgages out here?" The answer? A resounding YES!! We close loans in all 10 provinces and 3 territories. Provincial barriers are NOT a barrier with us. We stay on top of all things mortgage in every province and...

3 Reasons to Consider a 10-Year Term

The 10-year fixed-rate mortgage has generated renewed interest lately as borrowers look to lock in for the long term and enjoy the security and peace of mind this brings. With mortgage rates at all-time lows, it turns out that fashion isn’t the only thing that comes...

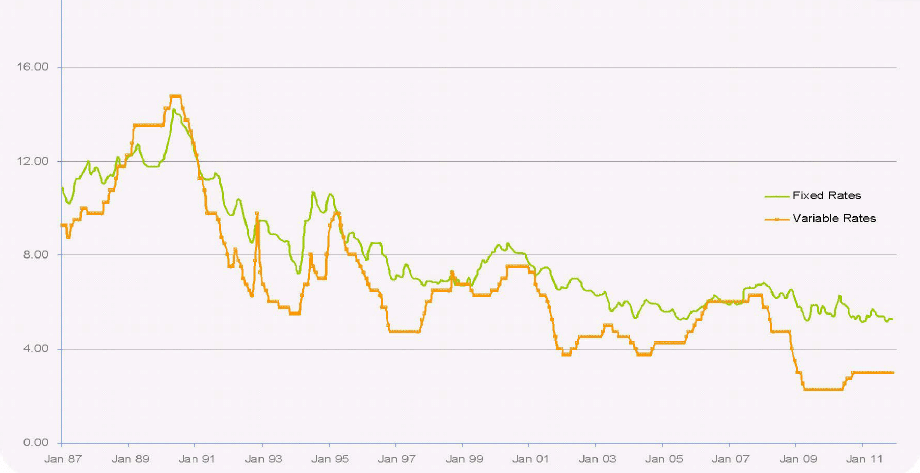

Variable or Fixed, You Make the Decision

Have you heard of the “50 point spread rule”? See the graphic (click on it for the FULL document) then let's talk when determining between Variable and Fixed.

Some Great Tips on Refinancing

If you are looking into refinancing your mortgage, there are several steps you can take to get a better mortgage rate. You will hear that comparison shopping is your best bet on getting a great new rate, but there are alternative measures you can take as well! Here...

Teamwork Means Everything

When your favorite team wins or, (for example) when that project is finished how do you feel? Are you completely thrilled and excited? Yes, me too! That's how I feel! Most often, a VERY successful campaign (game, project, etc.) no matter WHAT it is, occurs...

What to Look For in a Mortgage Specialist

Once in a while someone has already said exactly what you want to say. Which is the case today. I'm borrowing with gratitude a fantastic post by Better Borrower, regarding What to Look For in a Mortgage Specialist. "What makes a good mortgage specialist, how do you...

First-time Home Buyer Bonus

With the B.C. Provincial Budget coming out last week there was some good news for first time B.C. home buyers! The bonus is equal to 5% of the purchase price of the home (or in the case of owner-built homes, 5% of the land and construction costs subject to HST) to a...

The Big Banks vs. B Lending

The world of mortgages is often an elusive one. According to CanadianMortgageTrends.com "Mortgages that are not insurable, income-qualified and owner-occupied are now attracting more scrutiny." The "Big Six" banks: National Bank of Canada, Royal Bank, The Bank of...

CMHC Backing Fewer Loans

You may have seen by now that the ... CMHC (is) backing fewer loans The Financial Post reports: Canada Mortgage and Housing Corp. is cutting back on mortgages it insures as the Crown corporation edges closer to a $600-billion cap imposed on it by the federal...

You Have Choices When It Comes To Your Mortgage

If you have not seen the "mortgage rate wars" that have been going on in the last little while, then you've been missing out! Rates are at their lowest in years, maybe decades! That being said, you MUST know that you Have Choices when it comes to your mortgage! You...

The Importance of a Good Credit Score

If you don't already know, a good Credit Score is imperative to buying a home. If this is YOUR year to get a mortgage and buy a home then this will be very important information for you. According to PropertyWire.ca: "With more Canadians living closer to the edge...

First Time Mortgage?

If you're like a good amount of people in this country, then you've never had a mortgage before. A mortgage can be a scary thing, but it really doesn't have to be! When we meet I will help walk you through the process of things like: what is needed to obtain a first...

Planning for 2012

For those of you who didn’t read the article in Canadian Mortgage Trends yesterday, I really think it’s worth taking a peek. In looking at the recent Manulife survey with 1000 clients the findings were quite interesting. This is the time of year in which you’re doing...

I Wish you a VERY . . .

It’s Paying to Lock In

To quote today’s Financial Post, “the days of getting any sort of discount on a variable rate mortgage are over — again.” Prime has stood at 3% at most major financial institutions, therefore the discount has meant a rate as low as 2.1% this year. This discount has...